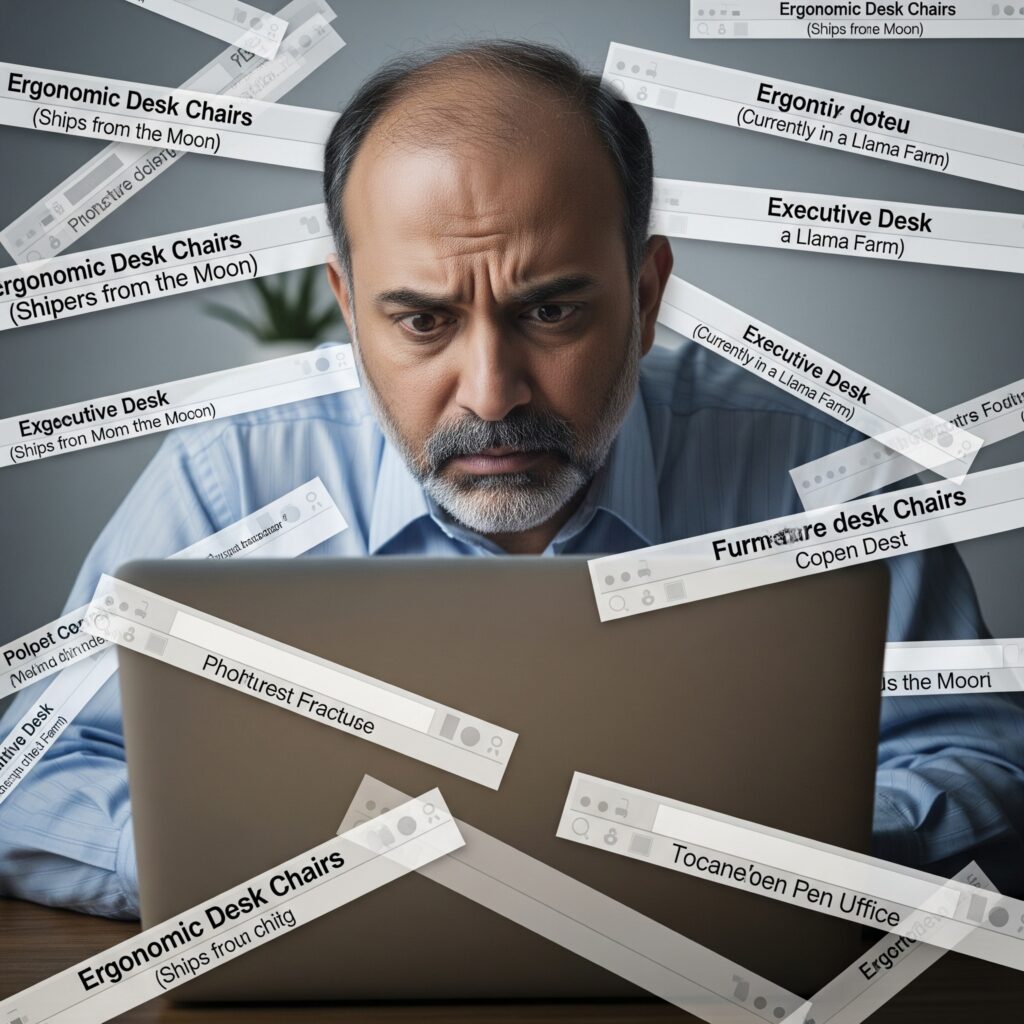

Beyond the Price Tag: Why Your Office Furniture Choice Matters More Than You Think (Especially When It’s Made in the USA) It’s a familiar scenario. You’re setting up a new home office, expanding a small business, or perhaps overseeing a massive corporate fit-out. The to-do list is long, and high on it is office furniture. For many, the decision boils down to a simple question: “What’s the most affordable option?” In a world saturated with online deals and global supply chains, the allure of a seemingly cheap price tag from an international conglomerate or a direct-from-overseas website is undeniable. But what if that ‘affordable’ choice comes with hidden costs – not just to your wallet, but to our communities, our planet, and even your long-term satisfaction? What if the truly savvy decision, the one that offers long-term benefits and genuine peace of mind, lies closer to home? This isn’t just about patriotism; it’s about practical advantages, economic resilience, and a stronger future for all of us. Let’s peel back the layers of the office furniture dilemma and discover why choosing American-made, especially from local, family-owned businesses like those you’ll find right here in Denver, can be a better way to go, no matter the scale of your needs. The Tangible Impact: American Jobs, Thriving Communities When you click “add to cart” on an internationally produced desk or chair, it might feel like a straightforward transaction. But every purchase has a ripple effect. When you choose American-made office furniture, that ripple effect is undeniably positive for our economy and our communities. Think about the direct jobs you’re supporting: the skilled designers in North Carolina crafting ergonomic solutions, the engineers in Michigan perfecting durable materials, the dedicated factory workers in Texas precisely cutting and assembling components, the upholsterers, the metal fabricators, the quality control specialists, and the administrative teams making it all happen. These aren’t just numbers on a spreadsheet; these are our neighbors, our friends, and our family members earning a living, providing for their families, and contributing to the economic vitality of their towns and cities. But the impact doesn’t stop there. Consider the indirect jobs. American furniture manufacturing relies on a vast network of domestic suppliers: lumber mills providing sustainably sourced wood, steel producers creating high-grade frames, textile manufacturers weaving durable fabrics, and countless small businesses providing everything from screws and bolts to specialized machinery. Then there’s the transportation and logistics network that moves these materials and finished products across the country, all supporting American jobs. When these jobs thrive, so do our communities. Strong local economies mean bustling main streets, better-funded schools, robust public services, and a higher quality of life for everyone. Buying American isn’t just a transaction; it’s an investment in the very fabric of our society. Here in Denver, and across the nation, countless family-owned businesses are at the heart of this industry. These aren’t faceless corporations; they are often multi-generational enterprises built on expertise, dedication, and a deep commitment to their craft and their community. They hire local, pay local taxes, and frequently participate in local charities and initiatives. They embody American pride – not just in the product they create, but in the innovation, craftsmanship, and unwavering dedication of American workers. When you buy from them, you’re not just a customer; you’re often supporting a neighbor’s dream and a local legacy. Navigating the Murky Waters: Tariffs, Taxes, and Hidden Fees The initial price tag of internationally sourced office furniture can be incredibly enticing. It’s often presented as the “budget-friendly” option. However, this upfront price can be deeply misleading, masking a labyrinth of potential costs that can quickly turn a supposed bargain into a budget headache. Let’s talk about tariffs. Simply put, tariffs are taxes imposed by a government on imported goods. Their purpose is often to protect domestic industries by making imported products more expensive, thereby leveling the playing field. But here’s the catch for consumers: tariffs directly increase the cost of imported furniture. That desk listed at $500 might suddenly jump to $600 or more due to a newly imposed tariff. The real challenge with tariffs, especially in our current global economic climate, is their unpredictability. We’ve seen firsthand how trade discussions and “tariff wars” can shift like desert sands. An order placed months in advance, with an agreed-upon price, can suddenly incur significant additional costs after the initial agreement, often just as the goods are about to ship or even arrive at port. When this happens, companies importing these goods must pass these increased costs on to the consumer. This isn’t greed; it’s economic necessity. No business can absorb indefinite, unexpected cost increases without impacting their bottom line or their ability to stay in business. You, the client, end up bearing the brunt of this unpredictability, whether through a revised invoice or a quiet adjustment in future pricing. Then there are shipping costs, which are far more complex than just the fuel needed to move a container. International shipping involves vast distances, often thousands of miles across oceans. Beyond basic freight charges, you contend with: Container Shortages and Port Congestion: Recent global events have highlighted how easily these can drastically inflate shipping costs and lead to significant delays. Think about demurrage (fees for containers sitting too long at port) and detention fees (fees for holding containers longer than allotted). These are real costs that get passed on. Customs Fees and Brokerage: Navigating international customs requires specialized knowledge and often involves fees for customs brokers, inspections, and processing. These are often overlooked but can add substantially to the total. Insurance: Protecting valuable cargo across vast distances is crucial, and that insurance comes at a cost. Finally, consider other taxes and fees. Beyond your standard sales tax, imported goods can be subject to specific duties or taxes that further inflate the final price. When you factor in potential tariff hikes, unexpected shipping surcharges, customs fees, and the potential for quality issues (which we’ll discuss next), the “cheap” international option often ends up